Pensions & Investments Award Winner

Award-Winning Plan

Financial security starts with a plan

Financial security starts with a plan

Common Good offers a modern workplace retirement plan designed to help not-for-profit workers save for their future.

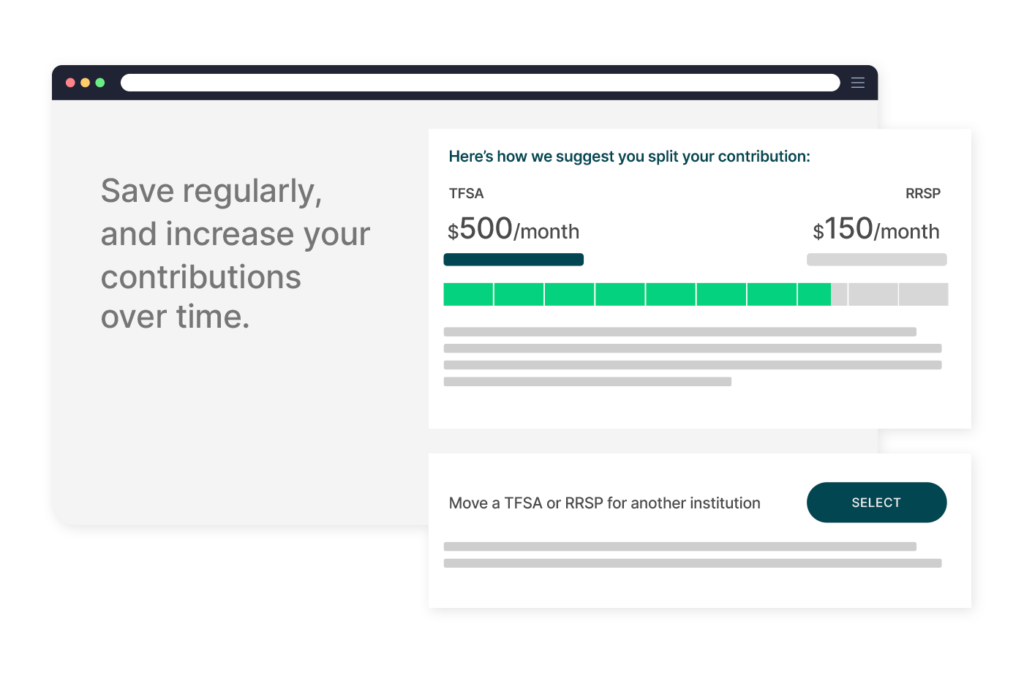

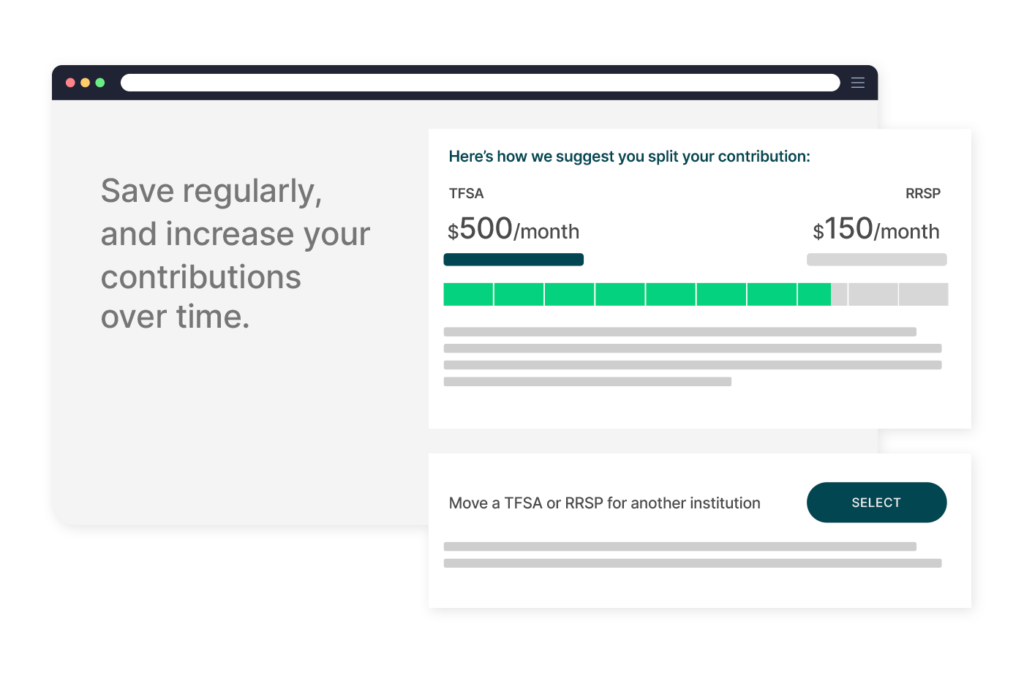

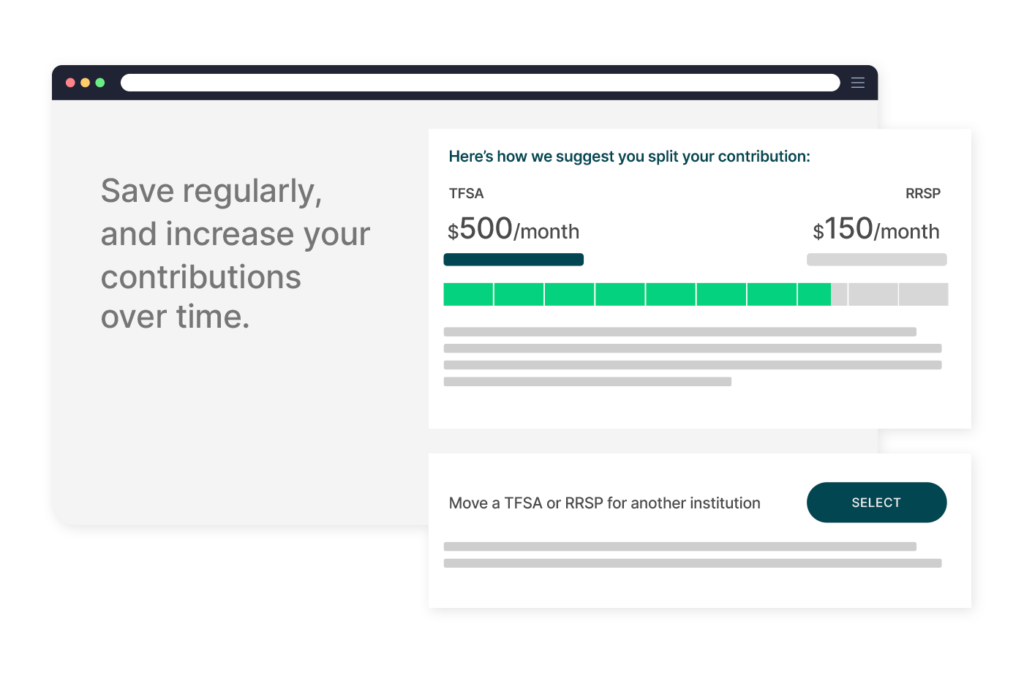

An easy way to plan and save for retirement

We’re helping those who spend their careers giving to others, build a secure financial future with a user-friendly RRSP/TFSA plan to grow their savings for retirement.

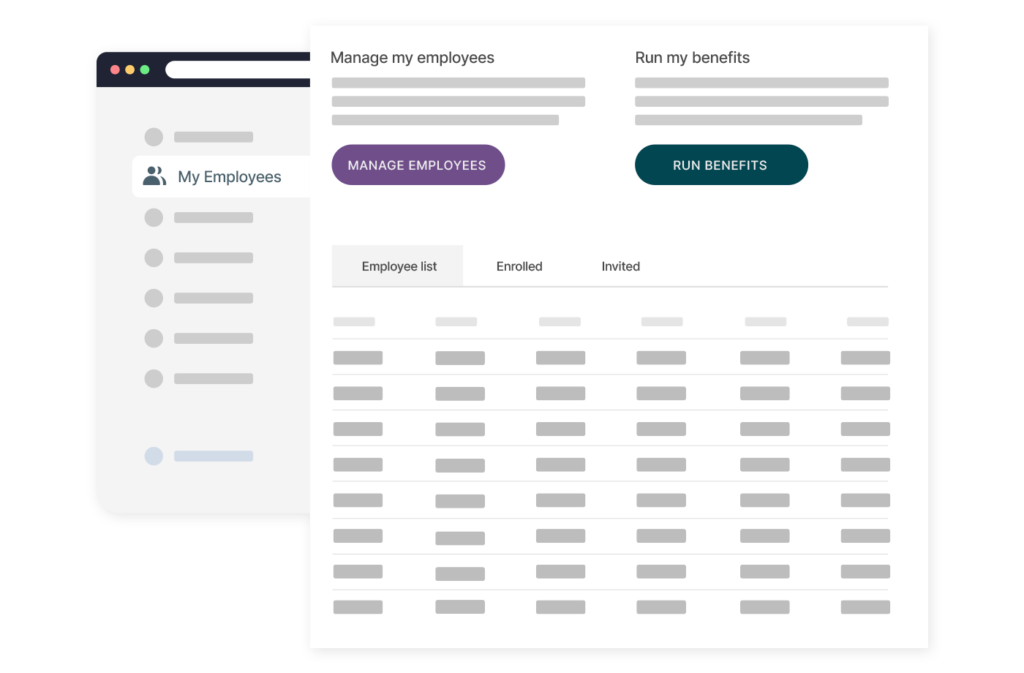

Employer benefits

Our fully digital retirement plan gives employers an easy way to set up and manage their plan.

- Flexible contribution and matching

- Fully digital setup and onboarding

- Guided enrollment and employee education

- Automatic payroll deductions

- Employees keep their plan for life

- Employees pay about 70% less than typical RRSP plans

Member benefits

- How much they need in retirement

- How much to expect from government benefits

- How much to save

- Where to invest

Attract & retain talent

The tightening labour market has many employers looking for creative ways to attract and retain talent. That’s why many growing companies are looking to introduce retirement benefits for their staff.

Advocating for not-for-profit workers

Roughly 850,000 people in the non-profit sector have no access to a workplace retirement plan.

Common Good is a result of community leaders coming together as a strong, collective voice to create a retirement plan using Common Wealth’s digital retirement platform.