Articles

Shariah-Compliant Investing: Understanding Your Investment Option

At Common Good, we are committed to providing investment options that align with our members’ values and financial goals. If you are looking for a

Your guide to finding and consolidating post-employment pension funds

Managing retirement savings can be a complex affair, especially when dealing with multiple accounts. It’s easy to lose track of your assets, miss opportunities, and

Year-end tax reporting deadlines for 2023

At the Common Good Plan, our job is to make workplace retirement benefits easy to manage – especially at year-end. To help make sure that

How much can I contribute to my RRSP?

With the RRSP deadline approaching, you may be wondering how much you can contribute to your Common Good Plan. General contribution limits for RRSPs, TFSAs,

Understanding investment risk

The Build My Own Portfolio feature within your plan includes a tool that measures the risk level associated with the portfolio you have chosen. This

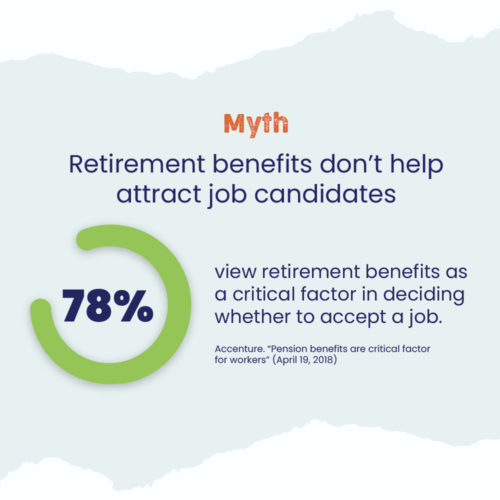

Comparing the costs of a retirement plan to employee turnover

How adding retirements benefits can save you money With employers under pressure to stay on budget and reduce expenses, it may seem counterintuitive to consider

Where should I save – TFSA or RRSP?

What account is best for retirement savings? Common Good Plan includes both a Tax-Free Savings Account (TFSA) and the Registered Retirement Savings Plan (RRSP). Both

The most impactful cost to cut in 2023: Employee turnover

By now, most experts agree that Canada is headed for an economic cooldown in 2023, but it’s likely to be short-lived – and it probably

Get the Common Good mobile app

Access your retirement plan anywhere, anytime! Our fresh, intuitive design makes it easy to keep track of your retirement plan from anywhere. Look up details

Year-end tax reporting deadlines for 2022

At the Common Good Plan, our job is to make workplace retirement benefits easy to manage – especially at year-end. To help make sure that

How to update your Common Good Plan when employees leave

When employees move on from your organization, whether it’s to a new role or into retirement, you want the transition to be as smooth as possible.

What to do with your Common Good Plan when you leave your job

When you leave your job – whether it’s for an exciting new opportunity or into retirement, one thing that won’t change is your access to your Common Good Plan.

Common Good’s investments are getting greener

At Common Good, we often get questions from employers and plan members about how sustainability and climate change fit into our investment approach.

Keeping your spirits (and savings) up when markets are down

Even if you’re not the type of person who reads financial news, you know by now that this year’s market returns so far haven’t exactly been… stellar.

4 smart ways to use your 2022 tax refund

Still deciding what to do with your tax refund? You’ve got options! Landing a bit of bonus cash can set off a battle of wills

Making retirement benefits attractive to first-time savers

The tightening labour market has many employers looking for creative ways to attract and retain talent. That’s why many growing employers are looking to introduce

Myth vs. Fact: Financial wellness at work

While more and more not-for-profit organizations are recognizing the need for workplace financial wellness programs, a group retirement plan may not be at the top

Join the Common Good Plan team

We are currently looking for an Account Executive to lead the growth of the Common Good Plan, specifically designed to help those in the nonprofit

Common Good Plan wins Award

The best in the global pensions and retirement industry were recognized at the 2021 Pensions & Investments‘ Innovation Awards in The Hague, Netherlands, and the

The first step to growing your retirement savings

The best, first, thing you can do for your retirement success is to start saving. Even if it is a small amount, start today. Every

Staying the course with your retirement savings

Preparing for retirement is a marathon, not a sprint. The longer you stick to a set of good retirement saving and spending habits, the more

Common Good Plan named as finalist for global industry award

The Common Good Plan is excited to be selected as a finalist for Pensions & Investments‘ WorldPensionSummit Innovation Award in Plan Design! P&I is one

How to keep your retirement plan up to date

Life can bring many exciting changes! A salary raise, parental leave, a job change, an inheritance, or finally retirement – all of these events have

Now is the time to provide a group retirement plan

Inertia is a common foe encountered by individuals when planning for retirement. Whether due to discomfort around the topic, other financial needs taking priority, or

Protecting your employees’ interests

Employers who set up group retirement plans are looking to do the right thing for their employees’ financial future. One way to protect your employees

Common misconceptions about retirement planning

Myth: There’s no point preparing for retirement.Reality: Preparing for retirement will make your life much better. “I’ll never be able to retire, so why bother

Common Good Plan Aims To Help Economically Vulnerable Not-for-Profit Workers Emerge from the Pandemic Financially Stronger Than Ever

News Release National coalition of mission-driven organizations launches a new retirement plan for the long underserved sector TORONTO, May 13, 2021 – The Common Good

The bank is on your side: Myth or reality?

Myth: The bank is there to help. Reality: The financial services industry usually makes things harder. Unfortunately, the financial services industry is part of the

How do we encourage our employees to participate?

Establishing a healthy saving routine is arguably the most important step your employees can take towards becoming retirement-ready. There are a few ways to encourage

Three questions to ask when evaluating your current group retirement plan

Is it actually a retirement plan (or just an investment account)? Many group “retirement” plans are not really retirement plans. They are basically investment accounts, where employees can choose from

Are You Ready for RRSP Season?

RRSP season has arrived, and you may be wondering if anything’s changed with the pandemic. No need to fret – we have two quick tips

How much should I contribute as an employer?

This is one of the most common questions employers ask. There are a few different ways to answer it. How much can you afford? This

Making the case for a group retirement plan

If you’ve downloaded our guide on choosing a group retirement plan, you already know more than most Canadian employers. Hats off to you! You are

Setting a target retirement income

Learn how the Common Good Plan estimates how much you will need during your retirement years

Saving – How much is enough?

Learn how the Common Good Plan provides a suggested savings rate based on your target retirement income

Intro to target date funds

The Common Good Plan offers target date fund options that are tailor-made for retirement

TFSAs and RRSPs – Which to use?

You can use both a TFSA and an RRSP with the Common Good Plan

Overcoming human nature to build a better retirement

The Common Good Plan has incorporated concepts from behavioural finance, which explores how people make financial decisions, to help you achieve better retirement outcomes

Government benefits – When should I take CPP and OAS?

Your income level should inform when you access your Canada Pension Plan, Old Age Security, and Guaranteed Income Supplement benefits

Beneficiary designation in the Common Good Plan

Learn about some of the factors you may wish to consider in designating a beneficiary for your TFSA, RRSP, and RRIF in the Common Good Plan

Webinars

Stay tuned

Let us know if you’re interested in hosting a webinar for your organization!

Maytree Presents: Common Good Plan

Helping Not-for-Profit Workers Build a Secure Retirement

Straightforward retirement planning with the Common Good Plan

Five Good Ideas for building financial health through the workplace

Vantage Point Presents: Common Good Employer Information Session

Protecting financial security through a workplace-based response to COVID-19

Videos

Common Good Plan overview

Enrolling in your workplace plan with an employer match

Enrolling in your workplace plan

How to make a one-time contribution to your RRSP

How to transfer a TFSA/RRSP into your Common Good Plan

How to update your income

How to update your other savings

Employers

Employer Dashboard: Creating your account

Employer Dashboard: Adding employees to your plan

Employer Dashboard: Reviewing your employee requests

Employer Dashboard: Uploading your payroll register

How to stay on top of your group retirement plan

Testimonials

Danya O’Malley

PEI Family Violence Prevention Services

Angela Crockwell

Thrive

Katherine Carleton

Orchestras Canada

Meghan Moore

Loran Scholars Foundation

Liz Mulholland

Prosper Canada

Owen Charters

BGC Canada

The Common Good Plan for Canada’s not-for-profit sector