Managing retirement savings can be a complex affair, especially when dealing with multiple accounts. It’s easy to lose track of your assets, miss opportunities, and even lose money in the process. This struggle often hits home for those holding pension funds from past jobs, unsure about the best moves to make.

Bringing together your retirement savings

To provide you with a clear, concise view of your retirement forecast while reducing the cumulative impact of fees, Common Good Plan has made it fast and easy to consolidate your accounts – TFSAs, RRSPs, RRIFs, and now LIRAs and savings still in your former employer’s pension plan.

If you have pension funds from a previous employer, chances are your money is sitting in a Locked-In Retirement Account (LIRA), also referred to as a locked-in RRSP. These funds are earmarked solely for retirement and generally cannot be accessed until a certain age. A LIRA is similar to an RRSP, but regulations around these accounts vary by province and can have different rules governing access, beneficiaries, and withdrawal. You must convert a LIRA to a Life Income Fund (LIF) by the end of the year you turn 71.

Amidst the whirlwind of life changes, it’s easy to see why many Canadians find themselves with dormant locked-in accounts, but it is possible to uncover this hidden wealth, which can hold great potential for your retirement strategy.

Finding your LIRAs

Identifying your LIRAs is a crucial step in optimizing your retirement plan. You can start by reviewing your employment history and past pension arrangements. If you left your funds in an old pension plan, contact your former employer to speak with a human resources representative or pension administrator. If your pension was converted to a LIRA, you should be receiving annual statements from the financial institution holding your LIRA or LIF.

Leveraging locked-in funds for growth

Transferring a LIRA, or any assets still sitting in a previous pension plan, to your Common Good Plan can provide you with the flexibility and freedom to make your money work harder for your future.

- Consolidation for convenience: Consolidating all of your retirement assets into one account simplifies management and makes tracking your retirement savings easier and more efficient.

- Low-fee structure: Our low fee ensures that more of your money goes towards growing your retirement savings, rather than being eaten up by high management fees.

- Greater control, confidence, and support: Consolidating your accounts with Common Good grants you greater control over your savings, fostering confidence in your overall retirement goals. Our dedicated team is ready to assist you one-on-one as you organize your finances, ensuring that your plan grows and adapts alongside your evolving needs.

An effortless process for transferring in existing savings

Take Action: Moving your LIRAs

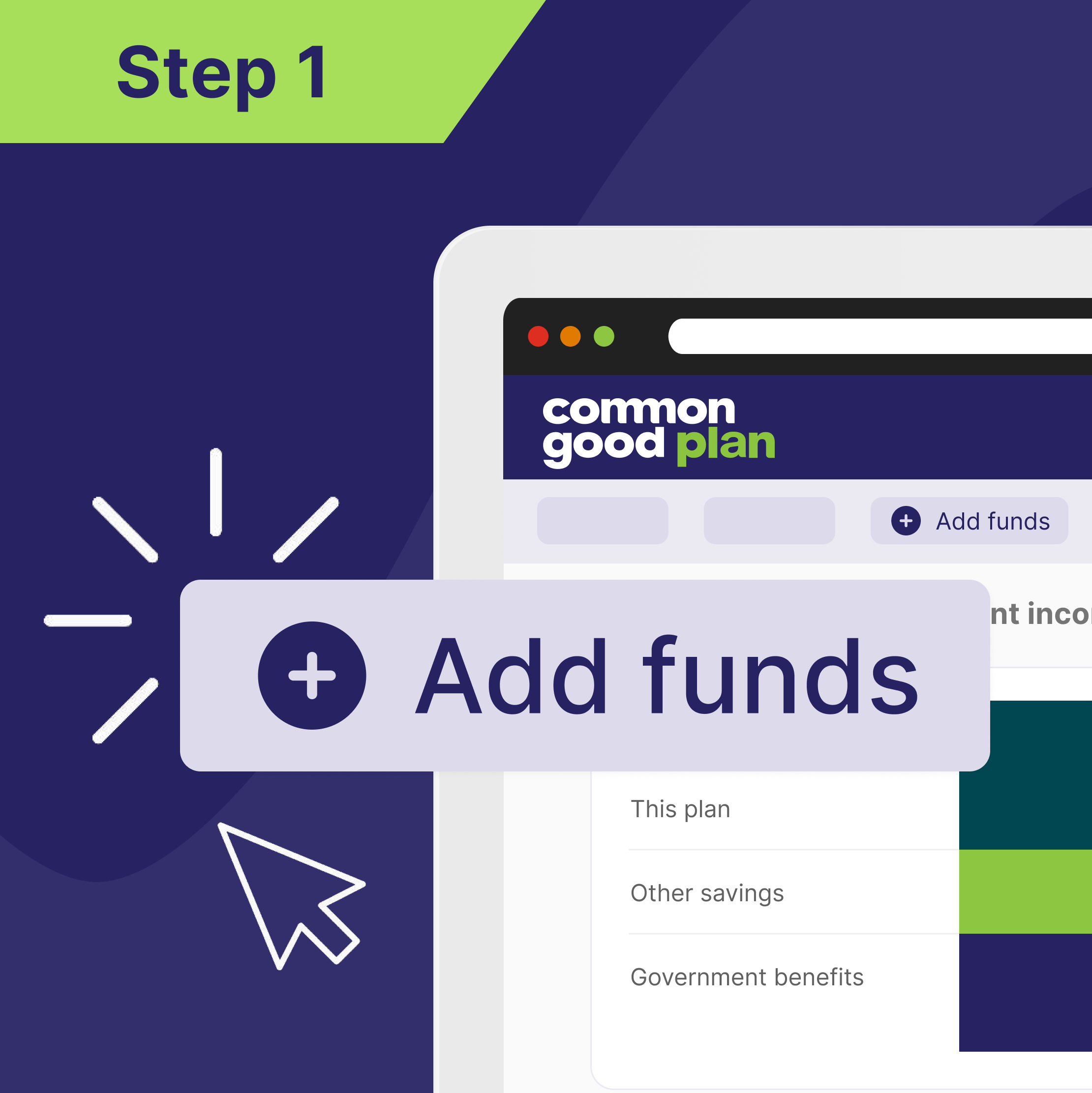

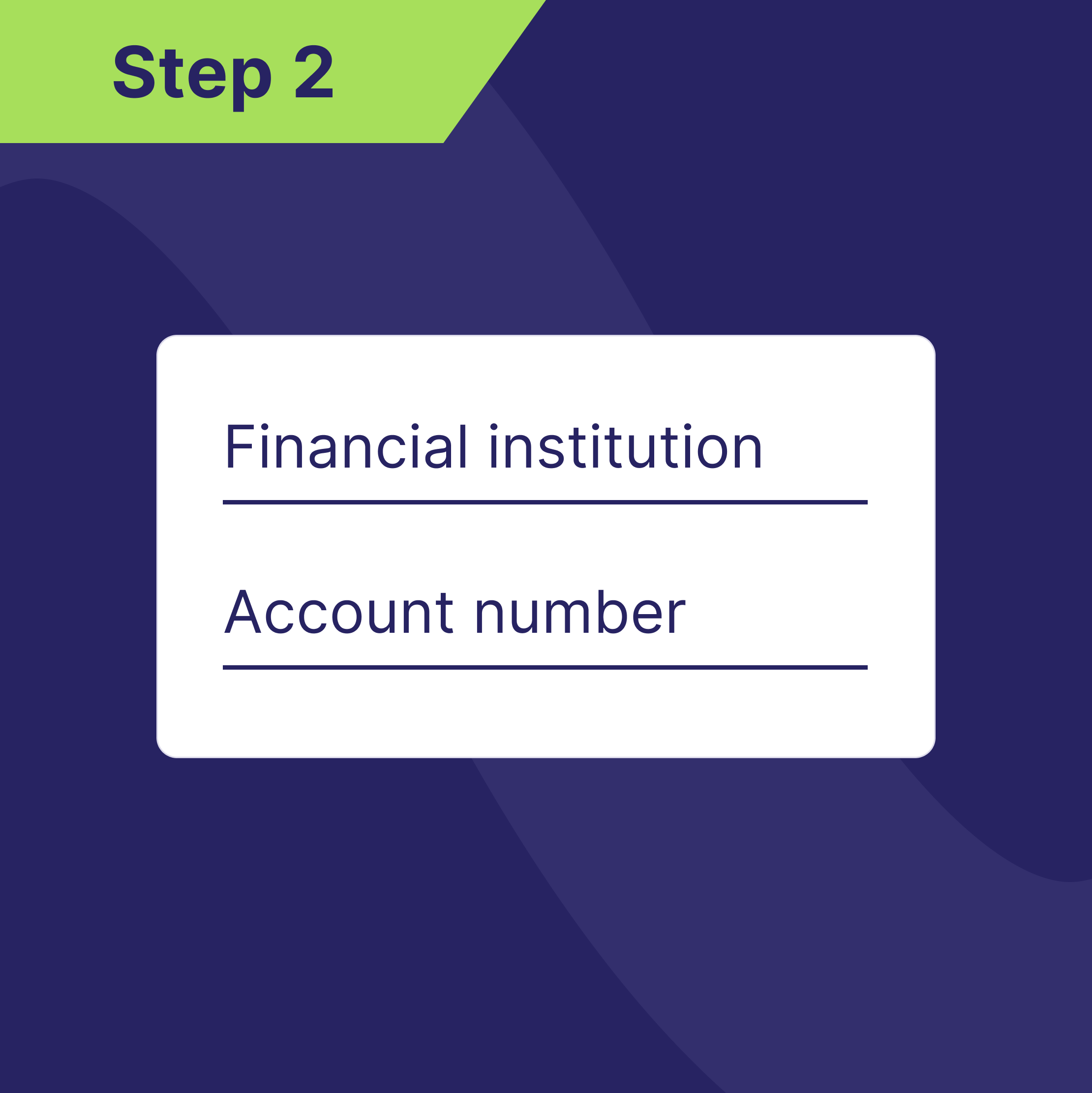

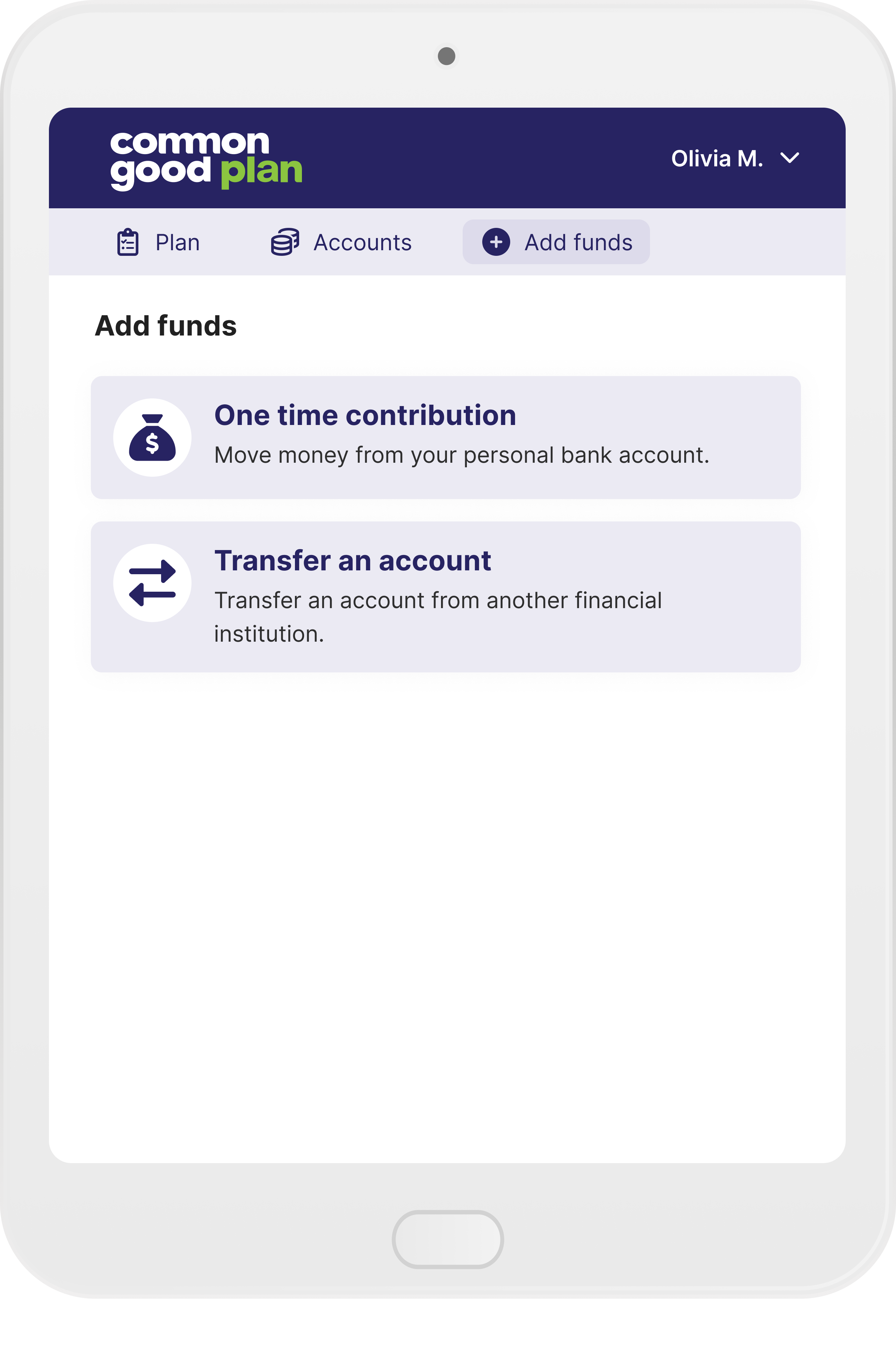

With Common Good, transferring your LIRA is quick and straightforward. On mobile or desktop, you can start the process in just a minute by clicking on Add funds > Transfer an account > RRSP. Simply provide the name of the relinquishing institution and your account number, and we’ll take care of the rest. We accept LIRAS from all provinces, so you don’t have to worry about the jurisdictional complexities or pension rules.

Once consolidated, LIRAs become an integral part of your Common Good Plan, so take the proactive step today. If you are looking to move a LIF or funds still in an old pension plan, we recommend speaking to one of our retirement specialists. For any questions about consolidation or your plan, you can book a 30-minute call.