Why enroll in your workplace retirement plan?

Why enroll in your workplace retirement plan?

Start growing your money in your workplace retirement savings plan

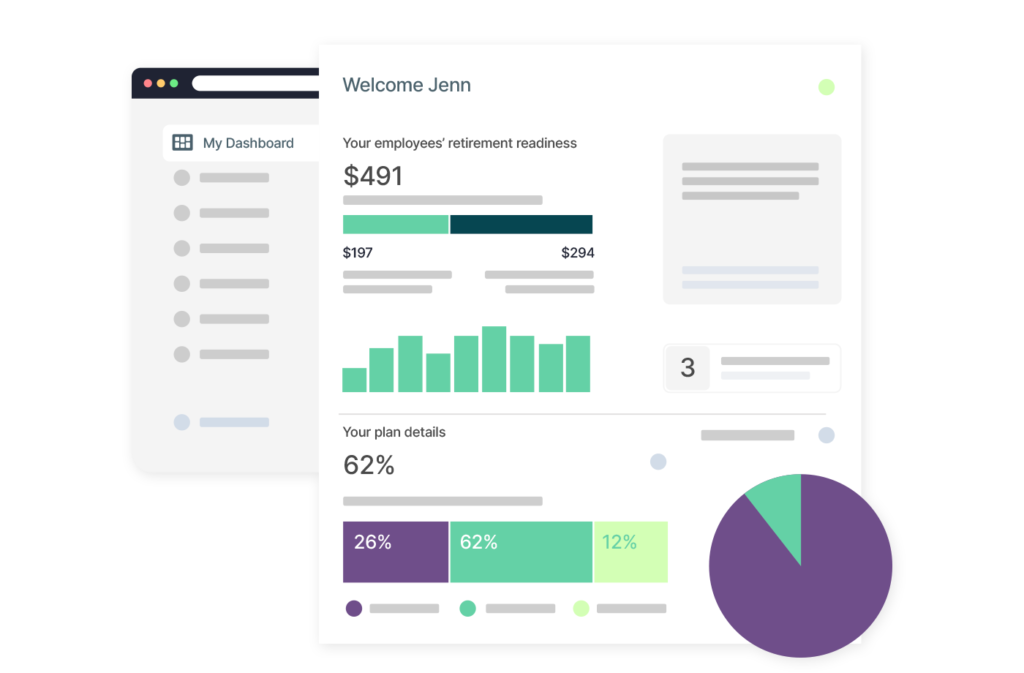

Common Good gives you an easy way to invest and grow your retirement savings

Saving $300 a month in your Common Good plan could result in $224,000 in 30 years, that’s $50,000 more than a typical RRSP.

The example above assumes a 5% growth rate, net of fees.

Grow your savings

A smart investing approach

When it comes to saving for retirement, most Canadians have to choose between investing in a high-fee bank RRSP that chews up a significant amount of their earnings, or learn to manage their own investments. With Common Good Plan, you get the best of both worlds: low fees and a professionally managed investment portfolio.

PLAN

Find out how much money you can expect from government benefits, how much you’ll need to save for retirement and a savings schedule to help you get there.

SAVE

Your plan comes with an RRSP and TFSA that you can contribute to right from your paycheque. You can also save from your bank account and transfer in any existing RRSP or TFSA.

INVEST

Your plan comes with streamlined investing that automatically balances and adjusts risk as you near retirement, so you can set it and forget it, while the plan works to grow your money.

Enhance retirement wealth by as much as 50%

The Pension Research Council at the Wharton School found that plan members using low-cost target date funds earned 2.3% higher returns each year, which can enhance retirement wealth by as much as 50% over 30 years.

World-class fund management

Common Wealth gives you access to low-cost, professionally managed target date funds from BlackRock®, the world’s largest asset manager.

Automatic risk adjustments

Target date funds are tailor-made for retirement. They optimize asset allocation based on age and automatically rebalance to become more conservative as you near retirement.

Portfolio diversification

BlackRock® target date funds include a mix of investments that change as retirement approaches to ensure that plan members stay appropriately invested. Each fund invests in over ten thousand different stocks, bonds and real estate in Canadian, US and International markets.

Simple choices, better outcomes

Common Wealth automatically matches members to an age-appropriate investment fund. This streamlined approach translates to higher participation, greater savings, and avoids the indecision and complexity created by overwhelming choice.

Our innovative approach is backed by over five years of in-depth customer and retirement research, legal diligence, and world-class investment solutions – and gives Canadians access to the best possible retirement outcomes for themselves and their families.

PLAN

Enroll in your workplace retirement plan today!

Setting up your account only takes about 10 minutes on your laptop or desktop computer.