Help your employees save for their future

Help your employees save for their future

Common Good offers nonprofit organizations with a modern group RRSP and TFSA plan

Common Good offers non-profit organizations with a modern group RRSP and TFSA plan

Build a happy, healthy and loyal work culture

Today’s hot talent market is being driven by a ‘work from anywhere’ culture, and a greater focus on financial security. That’s why innovative companies are enhancing their compensation strategy with retirement benefits.

BECOME A TOP EMPLOYER

Reinforce your culture of giving back, by supporting employee financial wellness

ATTRACT & RETAIN TALENT

Build a culture of happy, financially confident staff with an RRSP/TFSA match

BOOST

PRODUCTIVITY

Boost team productivity by relieving their financial stress

Offering a retirement plan is easier than you think

We’ve created an innovative digital plan that is easy to set up for employers and employees

Quick & easy plan setup

Common Good’s digital platform makes plan setup and ongoing maintenance easy.

- No investment knowledge required

- Self-service employee enrollment

- Flexible contribution and matching

- Automatic payroll deductions

- Online dashboard to manage users

Dedicated, expert support

- Flexible plan design

- Budget-friendly match options

- Guided employee onboarding and payroll integration

- Team demo and education

- Assisted employee enrollment

More than an investment account

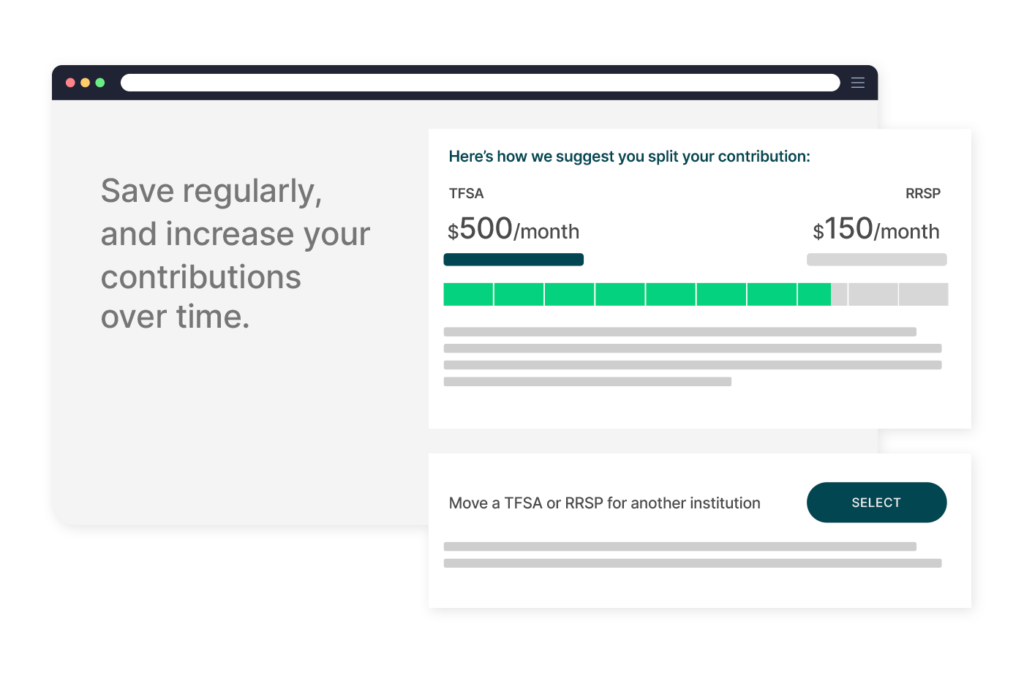

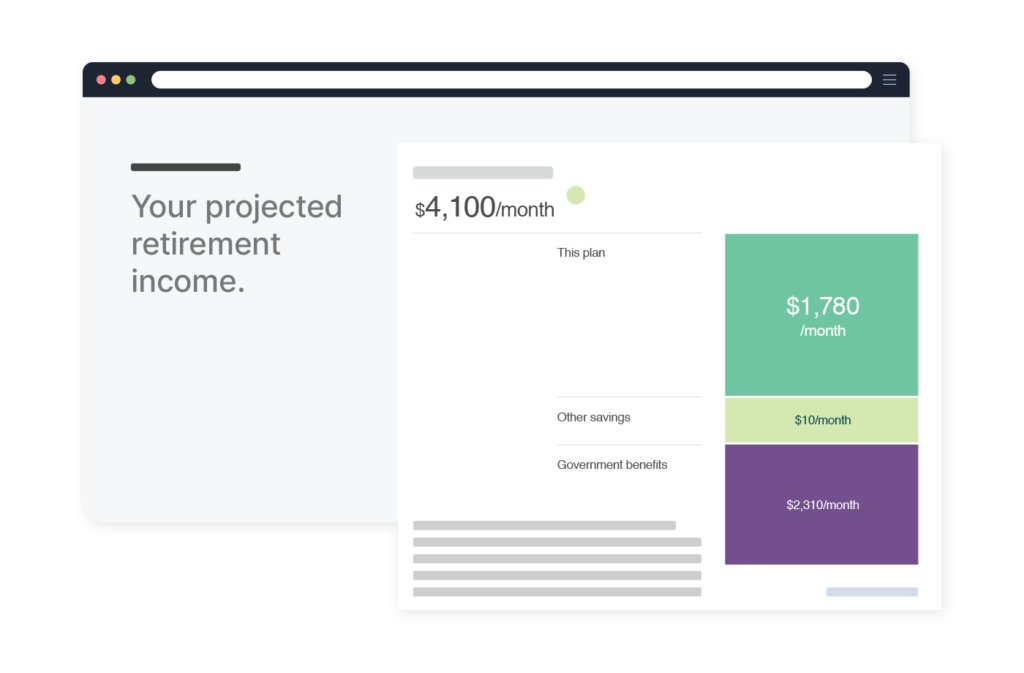

Unlike other plans, Common Good gives your employees personalized in-app planning so they know how much they can expect from government benefits, how much they’ll need in retirement, and how much to save each month to get there.

80% of people are more inclined to work for a company that offers matching contributions to their retirement savings plan.

Natixis, September 2021 Survey

Low fees

About 70% less than other providers, making it the ideal solution for small, medium, and large-sized organizations.

Fully digital setup

Plan setup and maintenance and employee onboarding are quick and easy, thanks to our completely digital experience.

Flexible plan design

We’ll help you structure a flexible contribution and matching plan that works for your company culture and your budget.

Payroll integration

We support a wide range of payroll systems, minimizing administration and freeing your time to focus on your organization.

Safe and secure

Our digital platform is SOC 2 compliant, ensuring your employee data and transactions are encrypted and secure.

Expert guidance

We offer expert retirement insights to help your employees make informed planning choices, so you don’t have to become the office financial advisor.

Hear from a Common Good employer

As the not-for-profit sector feels the impact of the Great Resignation, Katherine Carleton, Executive Director of Orchestras Canada, shares her desire to do better for her team by offering the Common Good Plan.

How do you choose the right group retirement plan?

The lack of innovation in the industry has resulted in high fees, poor service, and unnecessary complexity–specifically for small and medium-sized organizations. This guide will help you to navigate the group retirement landscape, so you can make the right choices for your team.

FROM THE BLOG

Shariah-Compliant Investing: Understanding Your Investment Option

Your guide to finding and consolidating post-employment pension funds

Year-end tax reporting deadlines for 2023

How much can I contribute to my RRSP?

Comparing the costs of a retirement plan to employee turnover

Where should I save – TFSA or RRSP?

The most impactful cost to cut in 2023: Employee turnover

Get the Common Good mobile app

Year-end tax reporting deadlines for 2022